Some homes on the market have additions that have not been permitted with their city. Perhaps the addition was self-built or done with an unlicensed group. The addition is well-built and seems to meet code, but the homeowner didn’t want to go through the trouble and cost of having a city inspector come out and verify this, which would result in a permit being issued.

Some homes on the market have additions that have not been permitted with their city. Perhaps the addition was self-built or done with an unlicensed group. The addition is well-built and seems to meet code, but the homeowner didn’t want to go through the trouble and cost of having a city inspector come out and verify this, which would result in a permit being issued.

The buyer can get a home inspector to confirm that everything is OK. However, a home appraiser that is sent by the lender to verify the property value, will not give any value to the unpermitted space. This can result in a lower appraisal and the need to re-negotiate the price, since the lender will only lend on the appraised value. Also, should the home be damaged, there might be some rebuild issues with the city or insurer.

Obviously, this is a problem for the seller. The best course is to get permits for any unpermitted space if you are selling a home. Or, having bought a home with unpermitted space, think ahead to getting it permitted. Regulations are only getting stricter, so that what was construction that was worthy of a permit in the past, could be sub-standard in the future.

According to the L.A. Times, prices for homes climbed 7.1% in Los Angeles County in January compared to the prices in January 2016. The median priced home was $525,000. In Orange County prices only climbed 2.6% in the last year, but the median home is $635,000. The number of homes for sale is much lower than the number of families who want to buy. That puts upward pressure on prices.

When will the dizzying price increases stop?

Usually, prices level off when homes are just not affordable to the majority of home buyers. A combination of higher prices and higher interest rates eventually makes buying a home too great a financial strain. So, far that tipping point has not been reached and prices will probably increase at least through the summer.

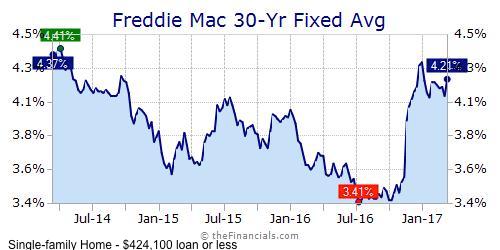

Regarding interest rates, the Federal Reserve is on a path to increase their rate several times this year. Another rate increase of one quarter percent is all but certain for this month. When this occurs, mortgage rates for variable rate mortgages (including home equity loans) will go up. Long-term fixed rate mortgages will also rise over time. Still, rates are no higher now than they were in 2014 (see chart below).

So, if you want to buy or refinance to get cash for home improvements or remove mortgage insurance, now would be the best time to do this, as rates will go higher from this point forward. Call me and we can see what makes sense for your situation.

With the April 18th personal tax return deadline just a few weeks away, the task of trying to get all of your information together in time may feel overwhelming or perhaps impossible. Fortunately, the IRS allows taxpayers to request a six-month filing extension, providing the request is received by the original filing deadline. However, while this may seem like a “get out of jail free” card, there are several important things you need to know!

With the April 18th personal tax return deadline just a few weeks away, the task of trying to get all of your information together in time may feel overwhelming or perhaps impossible. Fortunately, the IRS allows taxpayers to request a six-month filing extension, providing the request is received by the original filing deadline. However, while this may seem like a “get out of jail free” card, there are several important things you need to know!

Federal Tax Extensions

State Tax Extensions

While the IRS requires you file Form 4868 to request a tax extension, each state has its own requirements for obtaining a similar extension. Some states such as California offer automatic extensions to all taxpayers (as long as you pay whatever money you might owe by April 18th), while other states require you to file a specific form by the original due date of the return. Here are some tips to help walk you through what you need to do when filing state taxes in your area:

Article source: Truax Tax Advisors

(Excerpt from “Stay at 17 Inches” © 2016 Chris Sperry, Baseball/Life, LLC)

(Excerpt from “Stay at 17 Inches” © 2016 Chris Sperry, Baseball/Life, LLC)

Twenty-one years ago, in Nashville, Tennessee, during the first week of January, 1996, more than 4,000 baseball coaches descended upon the Opryland Hotel for the 52nd annual ABCA's convention.

While I waited in line to register with the hotel staff, I heard other more veteran coaches rumbling about the lineup of speakers scheduled to present during the weekend. One name, in particular, kept resurfacing, always with the same sentiment - "John Scolinos is here? Oh, man, worth every penny of my airfare."

Who is John Scolinos, I wondered. No matter; I was just happy to be there.

In 1996, Coach Scolinos was 78 years old and five years retired from a college coaching career that began in 1948. He shuffled to the stage to an impressive standing ovation, wearing dark polyester pants, a light blue shirt, and a string around his neck from which home plate hung - a full-sized, stark-white home plate.

Seriously, I wondered, who is this guy?

After speaking for twenty-five minutes, not once mentioning the prop hanging around his neck, Coach Scolinos appeared to notice the snickering among some of the coaches. Even those who knew Coach Scolinos had to wonder exactly where he was going with this, or if he had simply forgotten about home plate since he'd gotten on stage. Then, finally...

"You're probably all wondering why I'm wearing home plate around my neck," he said, his voice growing irascible. I laughed along with the others, acknowledging the possibility. "I may be old, but I'm not crazy. The reason I stand before you today is to share with you baseball people what I've learned in my life, what I've learned about home plate in my 78 years."

Several hands went up when Scolinos asked how many Little League coaches were in the room. "Do you know how wide home plate is in Little League?"

After a pause, someone offered, "Seventeen inches?", more of a question than answer.

"That's right," he said. "How about in Babe Ruth's day? Any Babe Ruth coaches in the house?" Another long pause.

"Seventeen inches?" a guess from another reluctant coach.

"That's right," said Scolinos. "Now, how many high school coaches do we have in the room?" Hundreds of hands shot up, as the pattern began to appear. "How wide is home plate in high school baseball?"

"Seventeen inches," they said, sounding more confident.

"You're right!" Scolinos barked. "And you college coaches, how wide is home plate in college?"

"Seventeen inches!" we said, in unison.

"Any Minor-League coaches here? How wide is home plate in pro ball?"

"Seventeen inches!"

"RIGHT! And in the Major Leagues, how wide home plate is in the Major Leagues?

"Seventeen inches!"

"SEV-EN-TEEN INCHES!" he confirmed, his voice bellowing off the walls. "And what do they do with a Big-League pitcher who can't throw the ball over seventeen inches?" Pause. "They send him to Pocatello!" he hollered, drawing raucous laughter. "What they don't do is this: they don't say, 'Ah, that's okay, Jimmy. If you can't hit a seventeen-inch target? We'll make it eighteen inches or nineteen inches. We'll make it twenty inches so you have a better chance of hitting it. If you can't hit that, let us know so we can make it wider still, say twenty-five inches."

Pause.

"Coaches... what do we do when your best player shows up late to practice? Or when our team rules forbid facial hair and a guy shows up unshaven? What if he gets caught drinking? Do we hold him accountable? Or do we change the rules to fit him? Do we widen home plate?"

The chuckles gradually faded as four thousand coaches grew quiet, the fog lifting as the old coach's message began to unfold. He turned the plate toward himself and, using a Sharpie, began to draw something. When he turned it toward the crowd, point up, a house was revealed, complete with a freshly drawn door and two windows. "This is the problem in our homes today. With our marriages, with the way we parent our kids. With our discipline. We don't teach accountability to our kids, and there is no consequence for failing to meet standards. We just widen the plate!"

Pause. Then, to the point at the top of the house he added a small American flag. "This is the problem in our schools today. The quality of our education is going downhill fast and teachers have been stripped of the tools they need to be successful, and to educate and discipline our young people. We are allowing others to widen home plate! Where is that getting us?"

Silence. He replaced the flag with a Cross. "And this is the problem in the Church, where powerful people in positions of authority have taken advantage of young children, only to have such an atrocity swept under the rug for years. Our church leaders are widening home plate for themselves! And we allow it."

"And the same is true with our government. Our so-called representatives make rules for us that don't apply to themselves. They take bribes from lobbyists and foreign countries. They no longer serve us. And we allow them to widen home plate! We see our country falling into a dark abyss while we just watch."

I was amazed. At a baseball convention where I expected to learn something about curve balls and bunting and how to run better practices, I had learned something far more valuable.

From an old man with home plate strung around his neck, I had learned something about life, about myself, about my own weaknesses and about my responsibilities as a leader. I had to hold myself and others accountable to that which I knew to be right, lest our families, our faith, and our society continue down an undesirable path.

"If I am lucky," Coach Scolinos concluded, "you will remember one thing from this old coach today. It is this: 'If we fail to hold ourselves to a higher standard, a standard of what we know to be right; if we fail to hold our spouses and our children to the same standards, if we are unwilling or unable to provide a consequence when they do not meet the standard; and if our schools & churches & our government fail to hold themselves accountable to those they serve, there is but one thing to look forward to...'"

With that, he held home plate in front of his chest, turned it around, and revealed its dark black backside, "...We have dark days ahead!"

Note: Coach Scolinos died in 2009 at the age of 91, but not before touching the lives of hundreds of players and coaches, including mine. Meeting him at my first ABCA convention kept me returning year after year, looking for similar wisdom and inspiration from other coaches. He is the best clinic speaker the ABCA has ever known because he was so much more than a baseball coach. His message was clear: "Coaches, keep your players-no matter how good they are-your own children, your churches, your government, and most of all, keep yourself at seventeen inches."

And this my friends is what our country has become and what is wrong with it today, and now go out there and fix it! Don't widen the plate.

John Scolinos was born in Los Angeles. He was a Hall of Fame College Baseball Head coach at Pepperdine University from 1946 to 1960 and California State Polytechnic University Pomona from 1962 to 1991. Scolinos totaled 1,198 victories. While coaching Cal Poly Pomona, he won Division II national championships in 1976, 1980 and 1983, along with six California Community College Athletic Association championships and was named Division II coach of the year three times. He was inducted into the American Association of Collegiate Baseball Coaches Hall of Fame in 1974. (from Wikipedia)

The large majority of homebuyers say that saving for a down payment is the biggest obstacle to their buying a home, according to a recent survey. Many buyers think they need to put 20% down to buy a new home. However, there are better options.

The large majority of homebuyers say that saving for a down payment is the biggest obstacle to their buying a home, according to a recent survey. Many buyers think they need to put 20% down to buy a new home. However, there are better options.

Today you can buy a home for as little as 3% down, or in some cases, only 1% down. These programs are not offered by all lenders.

Big banks and internet mega-lenders often have only one set of options, and getting you a mortgage is really a way to market more profitable products like auto loans, CDs and money management accounts. You might assume a bank that you’ve had accounts with for many years would make it easier to get a loan and give you a good deal. The bank customers who have come to me after frustratingly long waits for loan approval, difficulty reaching people with answers, and rates no better than a non-account holder would get, makes this assumption very doubtful.

A licensed, independent mortgage professional (like me) can shop your loan with multiple lenders to find the best rate and down payment that meets your needs. As an independent professional I can answer questions and work with you, even outside of “normal” business hours, or on weekends. Mortgages are my sole business and you won’t get on any marketing list for other products.

If you or your friends looking for their best options for a real estate loan, and great service too, have them call me at 818-952-8666 or email me. They will find a vast difference between an independent professional and the bank staffer.

A number of clients have asked me about why the APR (annual percentage rate) differs from the Note Rate (the interest rate on the mortgage loan). The APR is an artificial rate that combines the interest rate on the loan with any loan fees. So, if you are paying fees for the loan, the APR will be higher than the Note Rate.

A number of clients have asked me about why the APR (annual percentage rate) differs from the Note Rate (the interest rate on the mortgage loan). The APR is an artificial rate that combines the interest rate on the loan with any loan fees. So, if you are paying fees for the loan, the APR will be higher than the Note Rate.

The APR helps you see if a “too-good-to-be-true” low rate you are offered comes with fees, which might offset the benefits of that great rate.

However, sometimes it makes sense to pay higher costs to get a lower rate. If you plan to stay in your home for many years, over time (normally 4-7 years) the lower rate will have paid you back for the upfront costs and after that you will enjoy the lower rate savings.

Figuring out the best combination of rate and cost can be complicated. Give me a call if you have questions about current rates and costs. I’ll spell out your options and help you determine the best loan for your particular situation.

When you put money into remodeling or updating your home, you should consider the purpose of the upgrade. If it is to improve the value, updating kitchens and bathrooms are usually the areas where your money gives the most value. However, just because you have spent $50,000 on improvements, doesn’t mean your home is automatically worth $50,000 more. One man I knew spent well over $100,000 on improvements to his already beautiful home and was shocked to get an appraisal that only increased his value by a small fraction of that amount.

When you put money into remodeling or updating your home, you should consider the purpose of the upgrade. If it is to improve the value, updating kitchens and bathrooms are usually the areas where your money gives the most value. However, just because you have spent $50,000 on improvements, doesn’t mean your home is automatically worth $50,000 more. One man I knew spent well over $100,000 on improvements to his already beautiful home and was shocked to get an appraisal that only increased his value by a small fraction of that amount.

Home appraisers do not consider how much you spent on upgrades. They simply compare the newness and “modern-ness” of your home (primarily kitchens and baths) to other homes that have sold in your neighborhood. If your home is dated compared to others, your appraisal will show less valuation, whereas upgrading to match other homes will help match their value (their sale price). If other sold homes have not been renovated, and yours has, you will probably get some bump up in value, but probably not as much as you spent on the renovation.

So, the take-away from a valuation standpoint is that regardless of what you spent on renovations your appraised value is relative to other homes sold in your area.

Of course a remodel or update is not just about raising the value of your home. If you are planning to sell your home, renovating to bring your home up to a contemporary look will improve the appeal to prospective buyers. And, there is the very important factor of your comfort and enjoyment. If you are planning to stay in your home for a number of years, then some improvements that don’t raise your home’s value, may still raise your spirits and make your home more enjoyable.

If you are looking to remodel, a refinance can get you cash at a very low rate compared to other financing methods. I’ll be glad to help you explore the best financing for your project.

Whether or not you are looking to finance your home, it is always a good idea to make sure your credit profile is as high as it can be. If you are shopping for a home, car or even want to get a low interest credit card, your credit profile is the key to getting the best rate and terms. Your profile and credit score that accompanies it, is something that accumulates over time. It is very hard to change this quickly when you need a loan. Companies that promise this are bogus.

Whether or not you are looking to finance your home, it is always a good idea to make sure your credit profile is as high as it can be. If you are shopping for a home, car or even want to get a low interest credit card, your credit profile is the key to getting the best rate and terms. Your profile and credit score that accompanies it, is something that accumulates over time. It is very hard to change this quickly when you need a loan. Companies that promise this are bogus.

There are three credit bureaus that each calculate your credit score in a slightly different way. The bureaus are TransUnion, Equifax, and Experian. There is a commonality to these calculations, they rely heavily on a history of consistent on-time payments (no late payments) and the proportion of the balance on each credit card to the total credit line for the card.

A few tips on this.

I hope these tips will help you avoid negative surprises.

Until next time have a most enjoyable holiday season.

Your Friendly Lender,

David Kutner

It will be easier for millions of consumers to get loans for homes, cars and other large ticket items, according to the Wall Street Journal. Fair Isaac Corporation, the company that determines FICO credit scores, will not count collection accounts if the bill has been paid or settled with the collection agency. The company will also give less weight to unpaid medical bills that are sent for collection.

This is great news for those looking for home loans. With the change in scoring, many can now qualify for home loans, or see a lower rate on new loans they apply for.

See the complete article here:

http://online.wsj.com/articles/fico-recalibrates-its-credit-scores-1407443549?mod=yahoo_hs

Tomorrow the government will announce changes to the Home Affordable Refinance Program (or HARP) that are designed to help eligible borrowers refinance their mortgages, when their mortgage balance is more than their home is worth. Homeowners in this situation are considered “underwater” on their mortgages.

The program only applies to conventional loans (not FHA or VA loans) that were closed on or before May 31, 2009.

The major proposed change is to remove the current ceiling on how much “underwater” the borrower can be. Currently, the limit for a refinance is 125% of the home’s value, or 25% more than the home’s value.

Another proposed change is to eliminate certain fees if the borrower refinances into a shorter-term mortgage. If you have a 30-year loan, and refinance to a 20-year loan, you will avoid some fees. However, you might also pay a higher monthly amount because your loan would have to be paid off in a shorter period of time. This depends on the new interest rate and the years left on your current loan.

A third proposed change is to eliminate the need for a formal appraisal if a reliable automated value is available. This would save the appraisal fee of $300 or more.

To be eligible, a borrower must be current on his mortgage payments, cannot have missed any mortgage payments in the past six months and cannot have had more than one missed payment in the past 12 months. Additionally, the borrower cannot have refinanced through this program previously.

Also, the property must be the borrower’s primary residence and the loan must be owned by Fannie Mae or Freddie Mac.

Other conditions and restrictions are proposed. This will help homeowners who have been keeping up their payments, have sufficient income, but have not been able to refinance because of their home’s value.

We will be offering these loans as soon as the final guidelines are issued. I'd be happy to determine if your current loan is eligible for refinancing. Just contact me, 818-952-8666, or email: David@TheFriendlyLender.com.

A: Yes. Mortgage Brokers working in California must have both a Department of Real Estate (DRE) License and a Nationwide Mortgage Licensing System (NMLS) license. The state license certifies that the Broker knows how to do both real estate sales and loan origination and knows the regulations associated with both. The NMLS license certifies that the Broker knows the latest national regulations on mortgages and also involves an extensive background check to certify the Broker has not been guilty of criminal activities or financial irregularities (e.g., bankruptcies).

Note: Loan officers working in banks are not required to have either a DRE nor an NMLS license. Bank employees have been exempted from these rules.

A “No Points” loan is defined in different ways. The best description is a loan that has no lender fees (or points). (A “point” is equal to 1% of the loan amount.) But, there is “no free lunch.” When you hear these offered, the lender will give you a higher interest rate so that you pay back these fees (and points) over time with the higher payments.

Please note: With a No Point loan you will still have other costs associated with the loan (title, escrow, appraisal, etc.).

Yes, we can work out options for you to have some or all of your lender fees paid. We can even get the lender to pay some of the other costs associated with your loan.

-David